Olá! Meu nome é Roma, trabalho como desenvolvedor iOS na Exness. Além disso, escrevo em Clojure e invisto.

Hoje vou falar sobre como avaliar opções. Este é um artigo introdutório e é improvável que você possa ganhar um milhão usando o método proposto. No entanto, essa é uma boa base para entender métodos de avaliação mais complexos.

Clojure

Clojure?

, , .

, Clojure JVM, , , Java.

, REPL. Clojure, Jupyter Notebook . IDE .

, , – . , - :

(defn call-option-value [security-price strike-price]

(Math/max (- security-price strike-price) 0))

(call-option-value 360.0 280.0)

=> 80.0

(call-option-value 10.0 280.0)

=> 0.0

, . , - .

: , , , .

Clojure :

(-> (get-possible-outcomes) mean present-value))

-, :

(-> (repeatedly n simulate-outcome) mean present-value)))

-

, . .

, :

(defn gbm-step [price dt rate volatility]

(let [drift (* price rate dt)

shock (* price volatility (Math/sqrt dt) (gaussian))

change (+ drift shock)]

(+ price change)))

(gbm-step 1200 1/365 0.01 0.15)

=> 1207.554940519062

, , . .

, iterate .

Apple ($257) 100 :

(take 100 (iterate #(gbm-step % 1/365 0.01 0.15) 257))

=>

(257

258.6727911540819

256.91541924148663

252.98034966342195

251.1008036685261

...

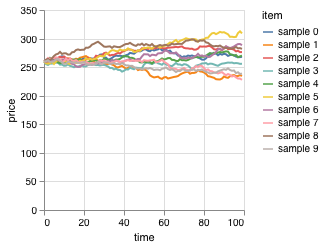

10 , :

, , :

(defn simulate-outcome [price strike rate volatility expiration]

(let [steps 100

dt (/ expiration steps)

prices (iterate #(gbm-step % dt rate volatility) price)

price-at-expiration (last (take steps prices))]

(call-option-value price-at-expiration strike)))

(repeatedly 5 #(simulate-outcome 1924 1925 0.01 0.45 0.5))

=> (0.0 730.6715047778875 329.1915857113486 0.0 0.0)

. , , , 1.

, :

(defn evaluate-call-option [& {:keys [security-price strike-price risk-free-rate volatility expiration]}]

(let [expiration (year-fraction-until expiration)

simulate-fn (partial simulate-outcome security-price strike-price risk-free-rate volatility expiration)

n 1000]

(-> (repeatedly n simulate-fn) mean (present-value risk-free-rate expiration))))

(evaluate-call-option

:security-price 1924

:strike-price 1925

:risk-free-rate 0.01

:volatility 0.45

:expiration (LocalDate/of 2020 4 17))

=> 74.66533445636996

Amazon 2100 2140 17 :

(for [strike (range 2100 2150 10)]

(evaluate-call-option

:security-price 1987

:strike-price strike

:risk-free-rate 0.01

:volatility 0.35

:expiration (LocalDate/of 2020 4 17)))

=> (23.9 21.1 16.4 15.5 15.3)

:

=> (22.9 20.6 18.35 16.4 14.6 13.6)

, .

. . , - cljfx .