Karya ini terinspirasi oleh artikel "Apakah Jaringan Saraf Impian dengan Uang Listrik?" , di mana penulis, tanpa melebih-lebihkan, terampil dalam kejelasannya menjelaskan mengapa penggunaan jaringan saraf tiruan pada data saham kosong tidak mengarah pada kesuksesan. Berikut ini adalah bagian yang sangat sukses, menurut pendapat saya:

« … , . , , , 200 . .»

, , , , , . . . . - ? , , «» ?

« , ?» — . , , , -. .

, , . , — . , (, , , ..) . … . , .

, , . «»/« » «» , « » — , , , , . .

, — GitHub .

, , : « , ?»

— , . .

, , sentiment analisys, … «. « »?» — . , .

, , . — . — , ? « » ? , ?

, , , . , , «» — , , «» — , () , () - «», () . , , .

, , , , :

- ;

- -;

- ;

- TensorFlow + Keras — one love.

3 — , .

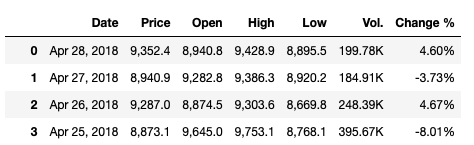

— . . , Google investing.com. CVS .

: Investing.com Bitcoin Index, Bitfinex Bitcoin US Dollar .

, . MIT, . .

, :

- bh.dat.gz — - . : (blockID), - (hash), (block_timestamp), (n_txs);

- tx.dat.xz — . : (txID), , (blockID), (n_inputs), (n_outputs);

- txout.dat.xz — . : (txID), (output_seq), , (addrID), (sum).

:

import pandas as pd

mit_data = pd.read_table('.../bh.dat',

header=None, names=['blockID', 'hash','block_timestamp', 'n_txs'])

mit_data['block_timestamp'] = pd.to_datetime(mit_data['block_timestamp'], unit='s')

out_txs_all = pd.read_table('.../txout.dat',header=None,

names=['txID', 'output_seq','addrID', 'sum'])

mapping_dataset = pd.read_table('.../tx.dat',

header=None, names=['txID', 'blockID','n_inputs', 'n_outputs'])

out_txs_all.drop('output_seq',axis=1,inplace=True)

out_txs_all.drop('addrID',axis=1,inplace=True)

out_txs_all = out_txs_all.groupby('txID').sum().reset_index()

mapping_dataset.drop('n_inputs', axis=1,inplace=True)

mapping_dataset.drop('n_outputs', axis=1,inplace=True)

mapping_dataset['sum_outs'] = out_txs_all['sum']

mapping_dataset.drop('txID', axis=1, inplace=True)

mapping_dataset=mapping_dataset.groupby('blockID').sum().reset_index()

mit_data.drop('hash', axis=1,inplace=True)

mit_data.drop('n_txs', axis=1,inplace=True)

mapping_dataset['Date'] = mit_data['block_timestamp']

mapping_dataset['sum_outs'] = mapping_dataset['sum_outs'].apply(lambda x: x/100000000)

mapping_dataset.to_csv('../filename.csv', index=False)

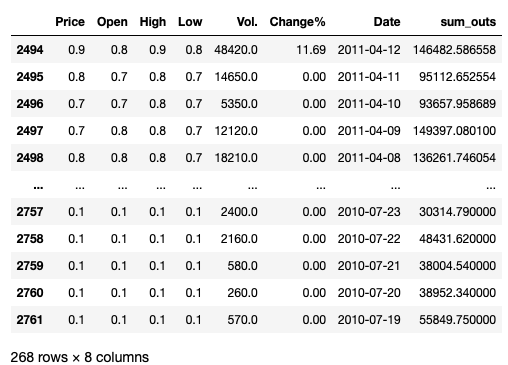

, 17.07.2010 08.02.2018. , , 08 2018 . , 2018 . — . — . API blockchain.com, .

:

API Blockchain.comimport requests

import json

limit_day = pd.to_datetime('2018-02-09')

datelist = pd.date_range(limit_day, periods=733).to_list()

date_series = pd.DataFrame(data=(datelist), columns=['Date'])

dt = pd.DatetimeIndex(date_series['Date']).astype(np.int64)//1000000

unix_mlseconds_lst = dt.to_list()

blocks_lst = []

for j in unix_mlseconds_lst:

request = requests.get('https://blockchain.info/blocks/'+str(j)+'?format=json')

parse_result = json.loads(request.content)

blocks_lst.append(parse_result['blocks'])

blockID = []

hashID = []

timestamp = []

for d_list in blocks_lst:

for dictionary in d_list:

blockID.append(dictionary['height'])

hashID.append(dictionary['hash'])

timestamp.append(dictionary['time'])

additional_bh = pd.DataFrame(data=(blockID,hashID,timestamp)).T

additional_bh.columns=['blockID','hash','timestamp']

additional_bh['timestamp']=pd.to_datetime(additional_bh['timestamp'], unit='s')

dates_out_sums = {}

for indx in range(len(additional_bh)):

request = requests.get('https://blockchain.info/rawblock/'+str(additional_bh['hash'][indx]))

parse_result = json.loads(request.content)

block_outs_sum=[]

for i in parse_result['tx']:

intermid_out_sum_values = []

for j in i['out']:

intermid_out_sum_values.append(j['value'])

block_outs_sum.append(sum(intermid_out_sum_values))

dates_out_sums[bh['timestamp'][indx]] = sum(block_outs_sum)

dates_out_sums_lst = dates_out_sums.items()

out_txs = pd.DataFrame(dates_out_sums_lst, columns=['Date', 'out_sums'])

out_txs['out_sums']=out_txs['out_sums'].apply(lambda x: x/100000000)

out_txs.to_csv('.../Data/additional_outs_dated(2018-02-09_2018-04-28).csv', index=False)

: blockchain.com , , . , , 11949 , . , .

, .

Data pre-processing

, , .

, , ‘K’, ‘M’ , float- . . . Python, !

str floatimport re

import pandas as pd

def strtofloatconvert(data):

price_lst = data['Price'].to_list()

open_lst = data['Open'].to_list()

high_lst = data['High'].to_list()

low_lst = data['Low'].to_list()

vol_lst = data['Vol.'].to_list()

change_lst = data['Change %'].to_list()

sprt_prices = []

sprt_open = []

sprt_high = []

sprt_low = []

sprt_p = []

sprt_o = []

sprt_h = []

sprt_l = []

for price in price_lst:

sprt_p = re.split(r',',price)

sprt_prices.append(sprt_p)

for open_p in open_lst:

sprt_o = re.split(r',',open_p)

sprt_open.append(sprt_o)

for high in high_lst:

sprt_h = re.split(r',',high)

sprt_high.append(sprt_h)

for low in low_lst:

sprt_l = re.split(r',',low)

sprt_low.append(sprt_l)

add_p = []

add_o = []

add_h = []

add_l = []

add_v = []

add_ch = []

for p in sprt_prices:

if len(p) == 2:

a = p[0]+p[1]

a = float(a)

add_p.append(a)

else:

a = p[0]

a = float(a)

add_p.append(a)

for o in sprt_open:

if len(o) == 2:

a = o[0]+o[1]

a = float(a)

add_o.append(a)

else:

a = o[0]

a = float(a)

add_o.append(a)

for h in sprt_high:

if len(h) == 2:

a = h[0]+h[1]

a = float(a)

add_h.append(a)

else:

a = h[0]

a = float(a)

add_h.append(a)

for l in sprt_low:

if len(l) == 2:

a = l[0]+l[1]

a = float(a)

add_l.append(a)

else:

a = l[0]

a = float(a)

add_l.append(a)

for v in vol_lst:

if v == '-':

add_v.append(0)

else:

exam = re.findall(r'K',v)

if len(exam)>0:

add = re.sub(r'K', '',v)

add = float(add)

add *= 1000

add_v.append(add)

else:

add = re.sub(r'M', '',v)

add = float(add)

add *= 1000000

add_v.append(add)

for i in change_lst:

add = re.sub(r'%', '',i)

add = float(add)

add_ch.append(add)

test_df = pd.DataFrame(data=(add_p, add_o, add_h, add_l,

add_v,add_ch)).T

test_df.columns = ['Price', 'Open', 'High', 'Low', 'Vol.', 'Change%']

return test_df

.

.

267 . .

, , , T-n, n — . . .

price = test_df.pop('Price')

price = price.drop(price.index[-1])

test_df = test_df.drop(test_df.index[0])

test_df.index = np.arange(len(test_df))

test_df = pd.concat((price,test_df), axis=1)

. , , , .

, - , , 45 .

PRACTICE_DS_SIZE = 45

later_testds_for_plot = test_df.iloc[:PRACTICE_DS_SIZE]

test_df = test_df.iloc[len(later_testds_for_plot):]

test_df = test_df.reset_index(drop=True)

, , . , , .

timestamps = test_df.pop('Date')

sum_outs = test_df.pop('out_sums')

— :

train = test_df.sample(frac=0.8, random_state=42)

test = test_df.drop(train.index)

train_labels = train.pop('Price')

test_labels = test.pop('Price')

.

def norm(train_data, data):

train_stats = train_data.describe()

train_stats = train_stats.transpose()

normalized_data = (data - train_stats['mean']) / train_stats['std']

return normalized_data

, .

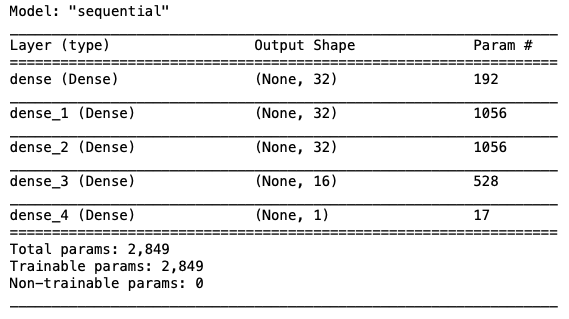

, , , :

def build_model():

model = keras.Sequential([

layers.Dense(32, activation='relu', input_shape=[len(train.keys())]),

layers.Dense(32, activation='relu'),

layers.Dense(32, activation='relu'),

layers.Dense(16, activation='relu'),

layers.Dense(1)

])

optimizer = tf.keras.optimizers.RMSprop(0.001)

model.compile(loss='mse',

optimizer=optimizer,

metrics=['mae', 'mse'])

return model

model = build_model()

model.summary()

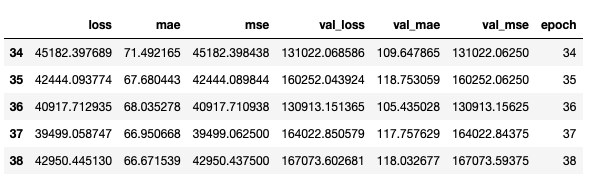

EPOCHS = 500

early_stop = keras.callbacks.EarlyStopping(monitor='val_loss', patience=10)

model.fit(normed_train_data2, train_labels2, epochs=EPOCHS,

validation_split = 0.2, verbose=0, callbacks=[early_stop, PrintDot()])

PrintDot() — . TensorFlow. . :

class PrintDot2(keras.callbacks.Callback):

def on_epoch_end(self, epoch, logs):

if epoch % 100 == 0: print('')

print('.', end='')

— , .

, .

.

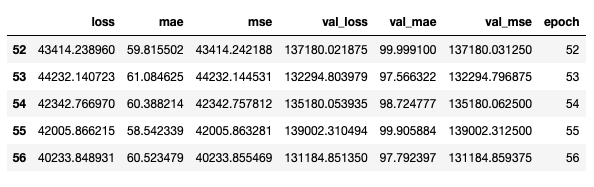

loss, mae, mse = model.evaluate(normed_test_data, test_labels, verbose=2)

: 506/506 — 0s — loss: 36201.9241 — mae: 66.5216 — mse: 36201.9219

MSE 45430.1133 190.27 . .

, .

loss, mae, mse = model.evaluate(normed_test_data2, test_labels2, verbose=2)

: 506/506 — 0s — loss: 24382.0926 — mae: 48.5508 — mse: 24382.0918

MSE 24382.0918 , 156.15 , , , , .

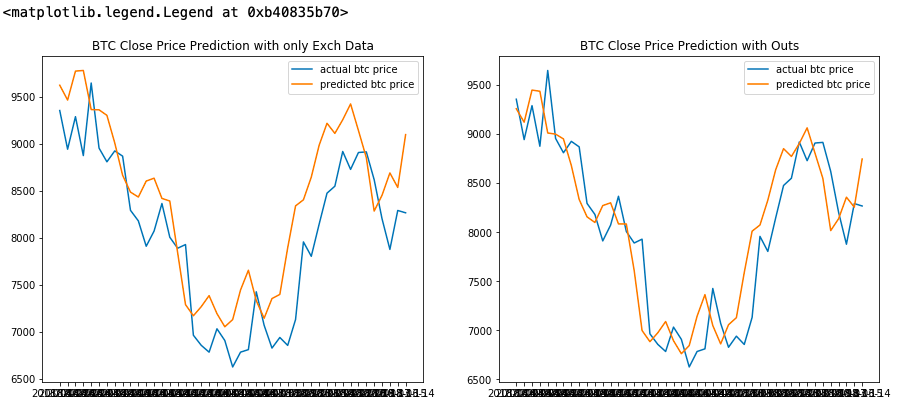

. .

actual_price = later_testds_for_plot.pop('Price')

actual_dates = later_testds_for_plot.pop('Date')

normed_practice_data = norm(train, later_testds_for_plot)

practice_prediction = model.predict(normed_practice_data).flatten()

actual_price2 = later_testds_for_plot2.pop('Price')

actual_dates2 = later_testds_for_plot2.pop('Date')

normed_practice_data2 = norm(train2, later_testds_for_plot2)

practice_prediction2 = model.predict(normed_practice_data2).flatten()

fig = plt.figure(figsize=(15,6))

ax1 = fig.add_subplot(121)

ax2 = fig.add_subplot(122)

ax1.plot(actual_dates,actual_price, label ='actual btc price')

ax1.plot(actual_dates,practice_prediction, label ='predicted btc price')

ax1.set_title('BTC Close Price Prediction with only Exch Data')

ax1.legend()

ax2.plot(actual_dates2,actual_price2, label ='actual btc price')

ax2.plot(actual_dates2,practice_prediction2, label ='predicted btc price')

ax2.set_title('BTC Close Price Prediction with Outs')

ax2.legend()

, , , . , , , , , .

, , . , , , .

, , « » ( - ), «».