RFM analysis allows you to take a fresh look at the customer base: these guys are about to leave us, let's try to keep them, but these guys have long lost interest - our promotional codes give them a dead poultice.

The job of compiling RFM segments is quite time consuming. But, with properly built communication with these segments, you get results in the form of customer retention and repeat sales.

RFM analysis - analysis of the customer base based on purchase history. RFM analysis occurs according to three indicators:

Recency - the prescription of the purchase - the period of time since the last purchase. Customers who bought recently are more likely to buy again.

Frequency - frequency of purchases - the number of purchases for a given period. The probability of selling to customers will be greater if a person has made many purchases.

Monetary - amount of purchases - the sum of all purchases for a given period. Customers who spend a large amount of money on purchases are likely to spend again.

As a result of RFM analysis, the groups of the most loyal and most money-generating customers and the most inactive are found. As a result, based on RFM analysis, it is possible to build communications in such a way as to stimulate the transition of customers from one group to another, to keep them and motivate for repeated purchases.

The RFM approach can be used in any business, regardless of the direction of activity, and it has the greatest visibility if there are more than 10,000 addresses in the database. The simplicity and visibility of segmentation is the main advantage of this approach.

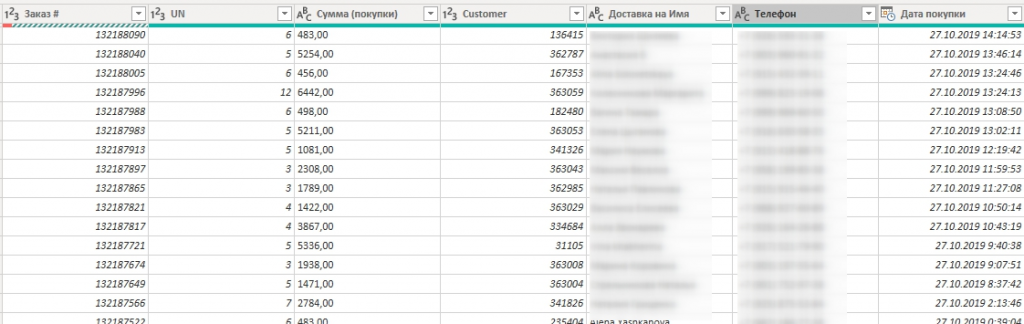

Source data for RFM analysis

To conduct an RFM analysis, you will need data on all purchases made by all customers and the sum of all these purchases. They are unloaded from CRM or analytics platform. For example, on projects where we did RFM analysis, the information was stored in Magento.

There may be difficulty with the data: it is unlikely that you will immediately receive them in perfect form, as a rule, preliminary data processing is required.

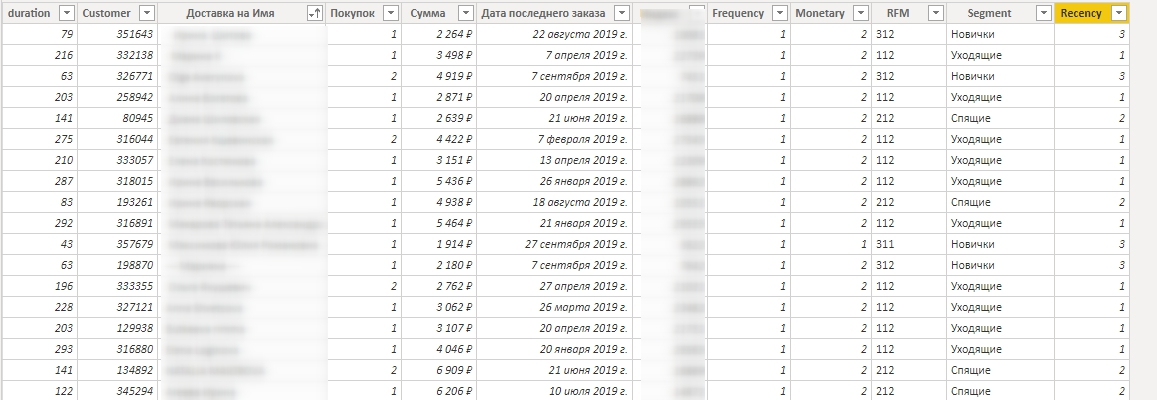

You will need a transaction upload. Each row is a separate transaction, the number of columns may be different, but it must be:

- unique identifier of the client (email, phone number, id);

- ;

- .

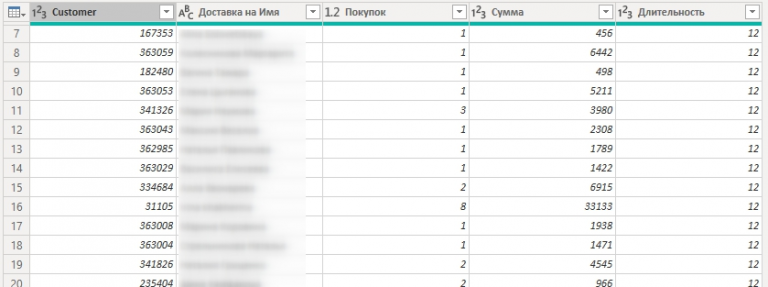

RFM-:

RFM-

1.

: (Recency), (Frequency) (Monetary).

2.

«Recency», «Frequency» «Monetary» .

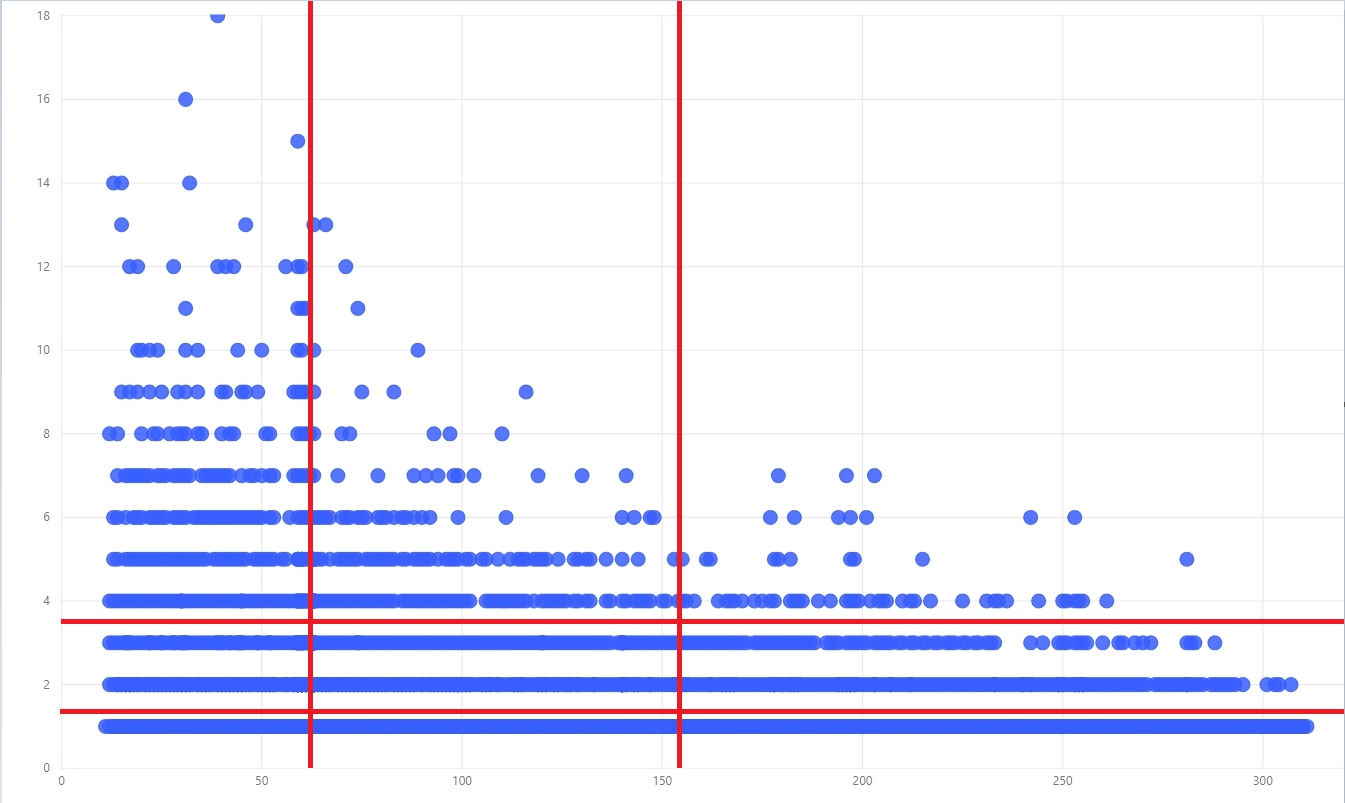

:

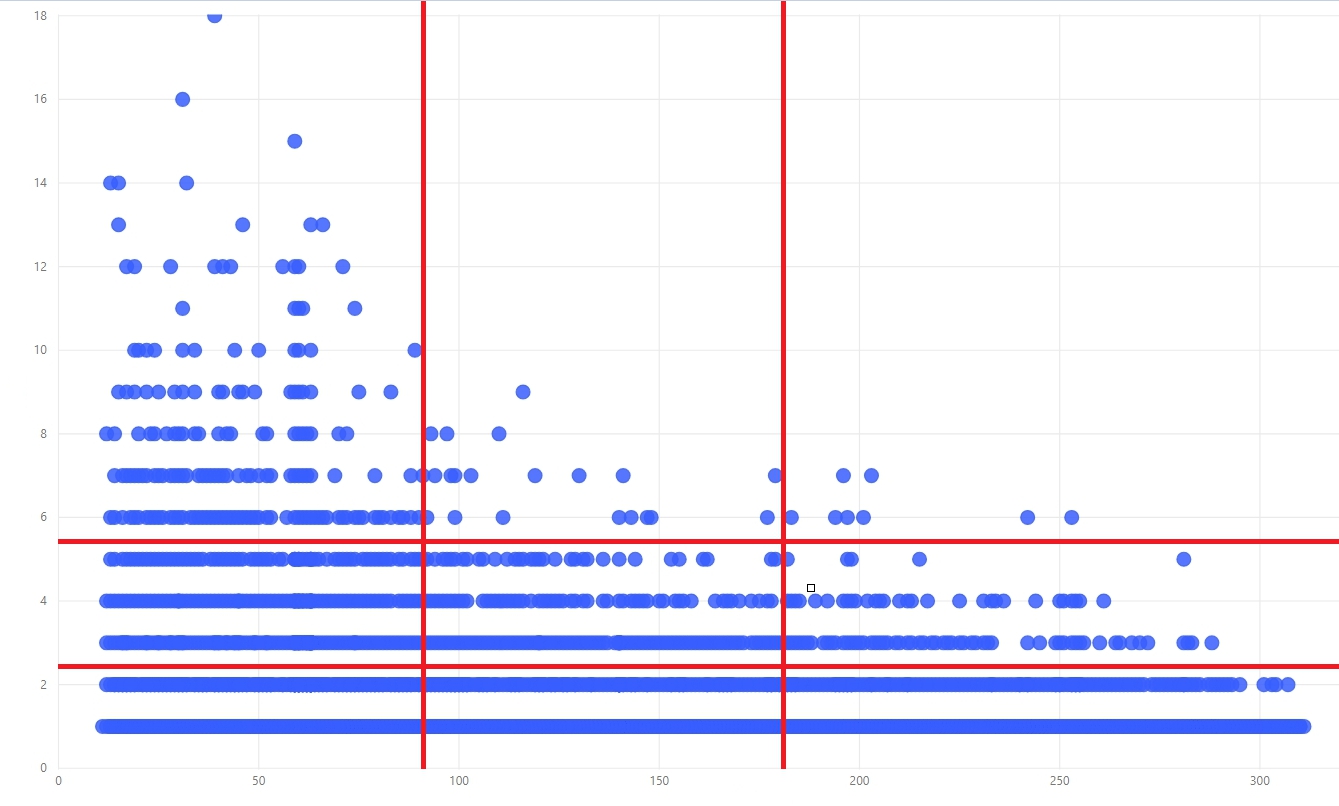

. , , .

:

106 6

, R F 3 .

Recency:

1 — 214–320

2 — 107–213

3 — 0–106

Frequency:

1 — 13–18

2 — 7–12

3 — 0–6

— . ( 90% , — 1%).

, .

, . — .

, Recency — — , .

. .

. , :

, , , .

, , Recency , Monetary — . Frequency .

:

Recency:

1 — 6

2 — 3-6

3 — 0-3

Frequency:

1 — 1–2

2 — 3–5

3 — 6

F, , , , . , , - . .

53 , — 36. , . , , .

. , 1 2 — , , , . , 1 2 — , .

Monetary — c — : , , , .

— 50 000 . , 4000 — ,

: , . . — , .

— . R, F, M .

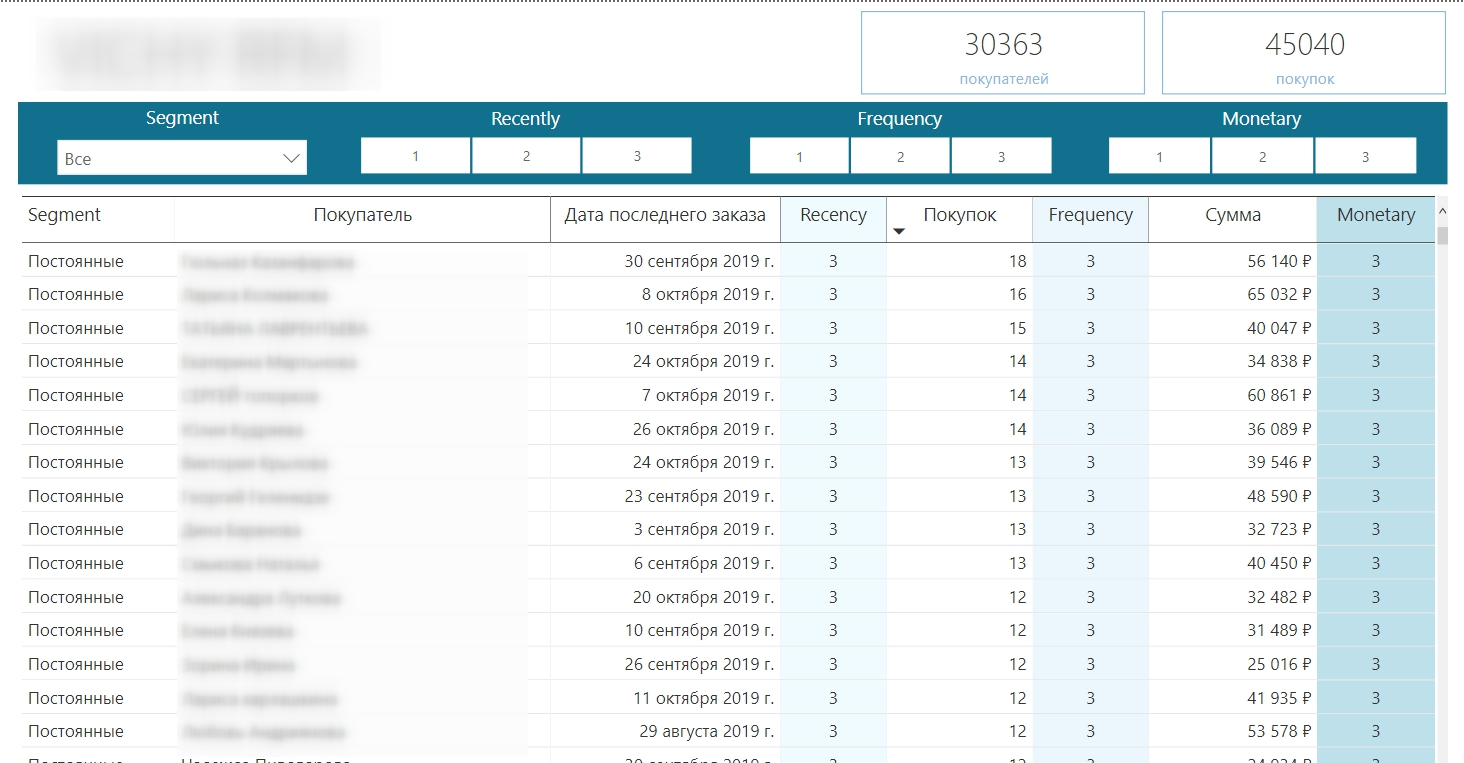

3. : R, F, M

, , — . , 1 3, , . 3 — .

, 1 — , 3 — . . :

- R1—F1—M(1-3) —

- R1—F(2-3)—M(1-3) — ,

- R2-F(1-2)-M(1-3) —

- R2-F(3)-M(1-3) —

- R3—F1—M(1-3) —

- R3—F2—M(1-3) —

- R3—F3—M3 —

:

:

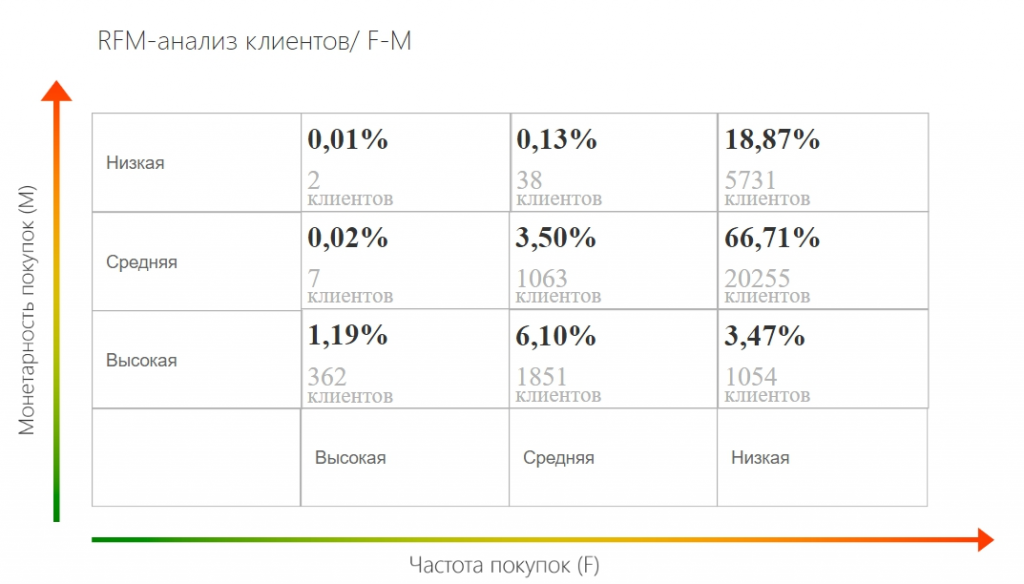

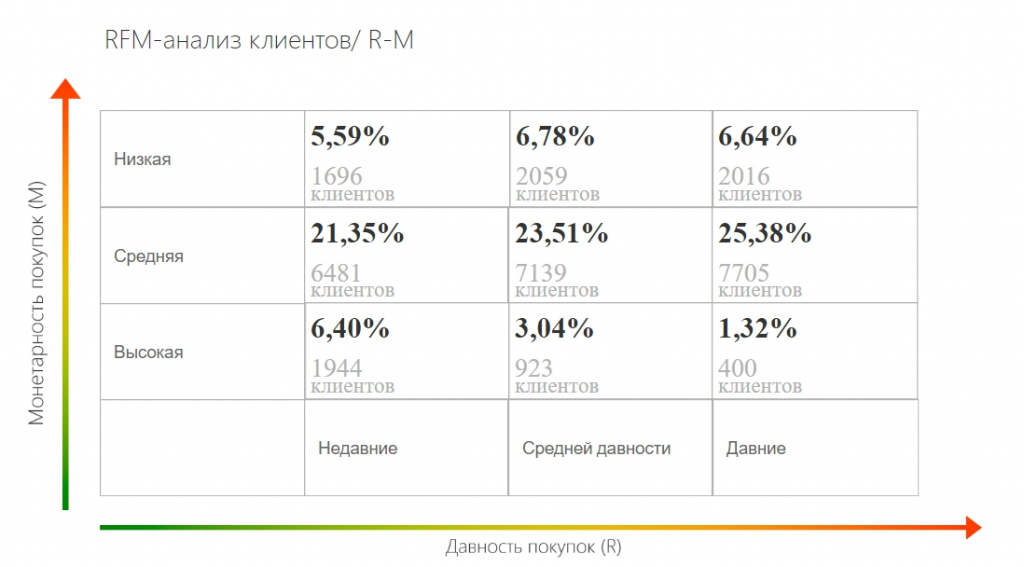

RFM-:

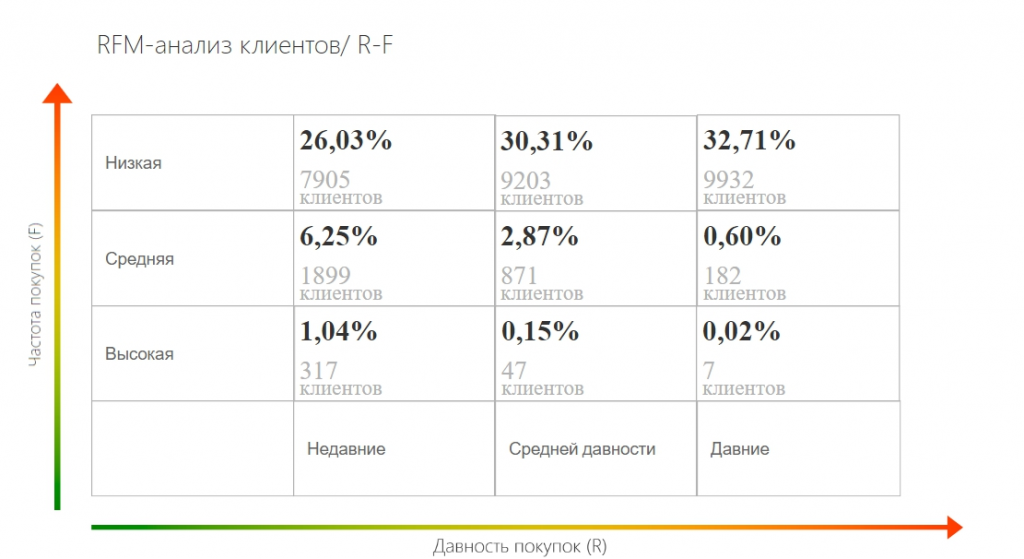

RF, RM, FM

RFM-.

RF-

. monetary — — frequency — , .

RF , , , .

RM-

RM- Recency Monetary. , , , .

FM-

FM- . , , , , , .