Why do altcoins die and what can happen to cryptocurrency in the near future?

Until 2017 Bitcoin's dominance almost always exceeded 80% of the total market capitalization, but during the 2017 bullrane, it first dropped to 37%. But by the fall of the 18th, altcoins had greatly lost in value, and the dominance of the first cryptocurrency again rushed up, reaching almost 70% in 2019. January 2020 began with a rebound of many viols, which took a bit% of capitalization from Bitcoin.https://t.me/CryptoRankNews/1235During the existence of the cryptocurrency market, many managed to bury both bitcoin and altcoins more than once. But what happened to them during this time? Let's try to figure this out in this article.How many times have Bitcoin been predicted to die?

According to 99bitcoins.com, Bitcoin has been buried 379 times already. In 2019, major media outlets announced the death of Bitcoin 41 times. The last time this happened was December 31, 2019, when analysts on Finance.Yahoo called Bitcoin a pyramid. However, Bitcoin is the largest cryptocurrency, and most of the TOP20 largest altcoins have almost completely disappeared since 2013, and new projects have taken their place. Projects such as Namecoin , Peercoin , and Feathercoin , popular in 2013, were supplanted by Ethereum , Monero , and EOS.. These projects not only disappeared from the memory of the cryptocurrency community, but were also completely abandoned by their creators. As a result, tokens depreciated and lost their liquidity.

However, Bitcoin is the largest cryptocurrency, and most of the TOP20 largest altcoins have almost completely disappeared since 2013, and new projects have taken their place. Projects such as Namecoin , Peercoin , and Feathercoin , popular in 2013, were supplanted by Ethereum , Monero , and EOS.. These projects not only disappeared from the memory of the cryptocurrency community, but were also completely abandoned by their creators. As a result, tokens depreciated and lost their liquidity.

Why do altcoins die?

Altks disappear in such numbers that even resources have appeared that track such tokens. The deadcoins.com website has 1839 dead projects, and the coinopsy.com database has 1407 such projects. There are also sites ready to buy tokens of endangered projects in order to make the crypto space more clean. Such a project includes, for example, coinjanitor.io. The largest number of dead projects occur in 2018. This is understandable, because the largest number of altcoins arose in 2017 with the ICO boom, and unfortunately they started to die as quickly as they appeared. And in 2019, the number of abandoned projects was significantly reduced to the very minimum. This is due to the fact that in 2018 there was a lull in the cryptocurrency market, bitcoin was at the bottom, and the number of tokensales and new coins dropped to lows. Also, there are fewer people who want to deceive someone, because collecting easy money from the market has become much more difficult.

The largest number of dead projects occur in 2018. This is understandable, because the largest number of altcoins arose in 2017 with the ICO boom, and unfortunately they started to die as quickly as they appeared. And in 2019, the number of abandoned projects was significantly reduced to the very minimum. This is due to the fact that in 2018 there was a lull in the cryptocurrency market, bitcoin was at the bottom, and the number of tokensales and new coins dropped to lows. Also, there are fewer people who want to deceive someone, because collecting easy money from the market has become much more difficult. According to coinopsy, the most common cause of altcoin deaths is the lack of liquidity on the exchange; no one wants to trade them.CryptoRank, as a platform that works daily with a large number of tokens, also agrees that this reason is the most common.Also, many coins cannot be called truly “live”, because, for example, the etherscan explorer database contains 235,267 token contracts and many of them could not even be listed on exchanges. Often projects do not have real users. Project whitewipers are copied, and sites look like a marketing page that is difficult to take seriously.Tokens die for various reasons: hacks, scam schemes from the creators, the pyramids, they did not collect the burl or loss of interest from the creators of the project.But according to coinopsy, the most common cause of token death is a lack of liquidity and a drop in trading volumes on exchanges to zero.But many sites that track the death of altcoins do not take into account the fact that more than 90% of exchanges have oversized trading volumes tenfold. As a result, we tried to create a ranking of exchanges, with significantly adjusted trading volumes.For examples of cryptocurrencies that have virtually ceased to exist, but on which exchanges claim a significant trading volume, you do not need to go far.An example is the ShineChain token (SHE) , which is traded on the FatBTC exchange .. At the time of publication, the exchange stated a daily token volume of $ 3,600,212. This volume is comparable to the top coins on the Binance exchange. The twitter of this project has not been updated since mid-2018, and the site and other social services. networks are not available at all. At the same time, trading volumes have increased significantly since the beginning of 2019. An almost empty trading glass also indicates manipulation , which for given trade volumes should be much denser and the same trading volume by day. Looks suspicious, doesn't it?

According to coinopsy, the most common cause of altcoin deaths is the lack of liquidity on the exchange; no one wants to trade them.CryptoRank, as a platform that works daily with a large number of tokens, also agrees that this reason is the most common.Also, many coins cannot be called truly “live”, because, for example, the etherscan explorer database contains 235,267 token contracts and many of them could not even be listed on exchanges. Often projects do not have real users. Project whitewipers are copied, and sites look like a marketing page that is difficult to take seriously.Tokens die for various reasons: hacks, scam schemes from the creators, the pyramids, they did not collect the burl or loss of interest from the creators of the project.But according to coinopsy, the most common cause of token death is a lack of liquidity and a drop in trading volumes on exchanges to zero.But many sites that track the death of altcoins do not take into account the fact that more than 90% of exchanges have oversized trading volumes tenfold. As a result, we tried to create a ranking of exchanges, with significantly adjusted trading volumes.For examples of cryptocurrencies that have virtually ceased to exist, but on which exchanges claim a significant trading volume, you do not need to go far.An example is the ShineChain token (SHE) , which is traded on the FatBTC exchange .. At the time of publication, the exchange stated a daily token volume of $ 3,600,212. This volume is comparable to the top coins on the Binance exchange. The twitter of this project has not been updated since mid-2018, and the site and other social services. networks are not available at all. At the same time, trading volumes have increased significantly since the beginning of 2019. An almost empty trading glass also indicates manipulation , which for given trade volumes should be much denser and the same trading volume by day. Looks suspicious, doesn't it?

This is how millions of trade volumes look for dead projects without a community and with founders who are most likely already busy with other things.As a result, when no real user buys this token or some other reasons arise from the exchange, for example, all pump dump schemes are won back, then the trading volume simply turns off (stops declaring) by the token and it is deleted.Every day we receive a lot of applications from new tokens that want to be added to CryptoRank , but many of them do not have a live community, sites, social networks, and are “dummies”.

This is how millions of trade volumes look for dead projects without a community and with founders who are most likely already busy with other things.As a result, when no real user buys this token or some other reasons arise from the exchange, for example, all pump dump schemes are won back, then the trading volume simply turns off (stops declaring) by the token and it is deleted.Every day we receive a lot of applications from new tokens that want to be added to CryptoRank , but many of them do not have a live community, sites, social networks, and are “dummies”.How did altcoins fall in 2019?

In 2019, much fewer projects entered the market, which should have had a positive impact on their quality. But many old and new projects continued to fall in 2019. Losses for many tokens, for which there were high expectations, amounted to more than 90%, and for some all 99%. Having invested $ 1,000 in such assets, the investor remained at best with $ 100. If in 2017 there was an ICO boom, then in 2019 IEO replaced it , which was supposed to improve the quality and performance of projects after entering the exchanges.IEO is the initial exchange offer, as its name implies, is held on the exchange platform. Unlike Initial Coin Offering (ICO), when raising funds on IEO, the exchange itself acts as an intermediary between investors and the project.The exchanges did not bother to select quality projects, as a result of the token metrics and the locks of the latter left much to be desired. And this is not surprising, most exchanges used IEO hype, only to catch up on the bull run of 2017. And long-term goals, for the implementation of which they helped to raise funds, went to the 2nd plan.

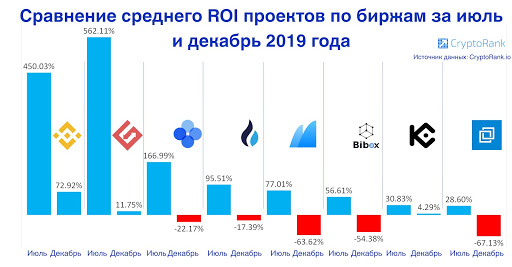

If in 2017 there was an ICO boom, then in 2019 IEO replaced it , which was supposed to improve the quality and performance of projects after entering the exchanges.IEO is the initial exchange offer, as its name implies, is held on the exchange platform. Unlike Initial Coin Offering (ICO), when raising funds on IEO, the exchange itself acts as an intermediary between investors and the project.The exchanges did not bother to select quality projects, as a result of the token metrics and the locks of the latter left much to be desired. And this is not surprising, most exchanges used IEO hype, only to catch up on the bull run of 2017. And long-term goals, for the implementation of which they helped to raise funds, went to the 2nd plan. The ROI of projects after raising funds on IEO at the top exchanges was quite high. For example, in July 2019, the average ROI for one of the leading exchanges - Binance, was about 450%, but in just half a year this figure fell to 72.92%. And for many other exchanges, this indicator even takes a negative value. Current ROI IEO platforms and exchanges are available online .

The ROI of projects after raising funds on IEO at the top exchanges was quite high. For example, in July 2019, the average ROI for one of the leading exchanges - Binance, was about 450%, but in just half a year this figure fell to 72.92%. And for many other exchanges, this indicator even takes a negative value. Current ROI IEO platforms and exchanges are available online .

What to expect next?

As a result, the situation for most altcoins and exchanges has not changed. Exchanges also continue to manipulate trading volumes in pursuit of short-term gains.Many alts continue to fall and it is very likely that they will go to a new bottom with a loss of liquidity. The pressure on prices will also be facilitated by the unlocking of tokens that are in the vesting period. In most tokens, a deflationary or other model that would help keep the token afloat is not thought out or does not work.Nevertheless, for the second year, many have been waiting for bullrun altcoins, as Xs, which they showed in 2017. very tempting. And in January 2020. many altcoins again made themselves felt, showing growth following the price of bitcoin .In 2020, large projects, such as TON, Dfinity, Hedera Hashgraph, Polkadot, and large stablecoins, such as Libra, the “digital yuan,” which can bring additional liquidity to the market, can enter the exchanges.We can observe an increase in the concentration of capital in coins with the highest capitalization. According to CryptoRank, the top 20 tokens occupy a very significant 87.6% share of the entire cryptocurrency market. And it is very likely that market density will continue to increase further, with the continued withdrawal of liquidity from small coins. Source: https://habr.com/ru/post/undefined/

All Articles