Diese Arbeit ist inspiriert von dem Artikel „Träumen neuronale Netze von elektrischem Geld?“ , wo der Autor ohne Übertreibung, talentiert in seiner Klarheit, erklärt, warum die Verwendung künstlicher neuronaler Netze auf bloßen Bestandsdaten nicht zum Erfolg führt. Hier ist meiner Meinung nach eine besonders erfolgreiche Passage:

« … , . , , , 200 . .»

, , , , , . . . . - ? , , «» ?

« , ?» — . , , , -. .

, , . , — . , (, , , ..) . … . , .

, , . «»/« » «» , « » — , , , , . .

, — GitHub .

, , : « , ?»

— , . .

, , sentiment analisys, … «. « »?» — . , .

, , . — . — , ? « » ? , ?

, , , . , , «» — , , «» — , () , () - «», () . , , .

, , , , :

- ;

- -;

- ;

- TensorFlow + Keras — one love.

3 — , .

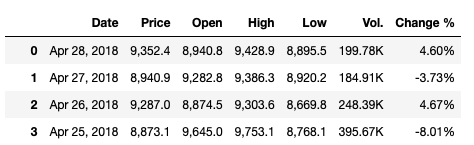

— . . , Google investing.com. CVS .

: Investing.com Bitcoin Index, Bitfinex Bitcoin US Dollar .

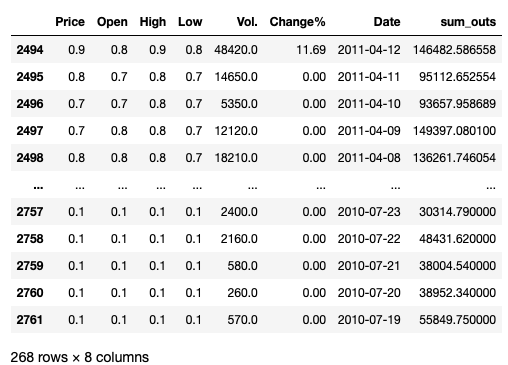

, . MIT, . .

, :

- bh.dat.gz — - . : (blockID), - (hash), (block_timestamp), (n_txs);

- tx.dat.xz — . : (txID), , (blockID), (n_inputs), (n_outputs);

- txout.dat.xz — . : (txID), (output_seq), , (addrID), (sum).

:

import pandas as pd

mit_data = pd.read_table('.../bh.dat',

header=None, names=['blockID', 'hash','block_timestamp', 'n_txs'])

mit_data['block_timestamp'] = pd.to_datetime(mit_data['block_timestamp'], unit='s')

out_txs_all = pd.read_table('.../txout.dat',header=None,

names=['txID', 'output_seq','addrID', 'sum'])

mapping_dataset = pd.read_table('.../tx.dat',

header=None, names=['txID', 'blockID','n_inputs', 'n_outputs'])

out_txs_all.drop('output_seq',axis=1,inplace=True)

out_txs_all.drop('addrID',axis=1,inplace=True)

out_txs_all = out_txs_all.groupby('txID').sum().reset_index()

mapping_dataset.drop('n_inputs', axis=1,inplace=True)

mapping_dataset.drop('n_outputs', axis=1,inplace=True)

mapping_dataset['sum_outs'] = out_txs_all['sum']

mapping_dataset.drop('txID', axis=1, inplace=True)

mapping_dataset=mapping_dataset.groupby('blockID').sum().reset_index()

mit_data.drop('hash', axis=1,inplace=True)

mit_data.drop('n_txs', axis=1,inplace=True)

mapping_dataset['Date'] = mit_data['block_timestamp']

mapping_dataset['sum_outs'] = mapping_dataset['sum_outs'].apply(lambda x: x/100000000)

mapping_dataset.to_csv('../filename.csv', index=False)

, 17.07.2010 08.02.2018. , , 08 2018 . , 2018 . — . — . API blockchain.com, .

:

API Blockchain.comimport requests

import json

limit_day = pd.to_datetime('2018-02-09')

datelist = pd.date_range(limit_day, periods=733).to_list()

date_series = pd.DataFrame(data=(datelist), columns=['Date'])

dt = pd.DatetimeIndex(date_series['Date']).astype(np.int64)//1000000

unix_mlseconds_lst = dt.to_list()

blocks_lst = []

for j in unix_mlseconds_lst:

request = requests.get('https://blockchain.info/blocks/'+str(j)+'?format=json')

parse_result = json.loads(request.content)

blocks_lst.append(parse_result['blocks'])

blockID = []

hashID = []

timestamp = []

for d_list in blocks_lst:

for dictionary in d_list:

blockID.append(dictionary['height'])

hashID.append(dictionary['hash'])

timestamp.append(dictionary['time'])

additional_bh = pd.DataFrame(data=(blockID,hashID,timestamp)).T

additional_bh.columns=['blockID','hash','timestamp']

additional_bh['timestamp']=pd.to_datetime(additional_bh['timestamp'], unit='s')

dates_out_sums = {}

for indx in range(len(additional_bh)):

request = requests.get('https://blockchain.info/rawblock/'+str(additional_bh['hash'][indx]))

parse_result = json.loads(request.content)

block_outs_sum=[]

for i in parse_result['tx']:

intermid_out_sum_values = []

for j in i['out']:

intermid_out_sum_values.append(j['value'])

block_outs_sum.append(sum(intermid_out_sum_values))

dates_out_sums[bh['timestamp'][indx]] = sum(block_outs_sum)

dates_out_sums_lst = dates_out_sums.items()

out_txs = pd.DataFrame(dates_out_sums_lst, columns=['Date', 'out_sums'])

out_txs['out_sums']=out_txs['out_sums'].apply(lambda x: x/100000000)

out_txs.to_csv('.../Data/additional_outs_dated(2018-02-09_2018-04-28).csv', index=False)

: blockchain.com , , . , , 11949 , . , .

, .

Data pre-processing

, , .

, , ‘K’, ‘M’ , float- . . . Python, !

str floatimport re

import pandas as pd

def strtofloatconvert(data):

price_lst = data['Price'].to_list()

open_lst = data['Open'].to_list()

high_lst = data['High'].to_list()

low_lst = data['Low'].to_list()

vol_lst = data['Vol.'].to_list()

change_lst = data['Change %'].to_list()

sprt_prices = []

sprt_open = []

sprt_high = []

sprt_low = []

sprt_p = []

sprt_o = []

sprt_h = []

sprt_l = []

for price in price_lst:

sprt_p = re.split(r',',price)

sprt_prices.append(sprt_p)

for open_p in open_lst:

sprt_o = re.split(r',',open_p)

sprt_open.append(sprt_o)

for high in high_lst:

sprt_h = re.split(r',',high)

sprt_high.append(sprt_h)

for low in low_lst:

sprt_l = re.split(r',',low)

sprt_low.append(sprt_l)

add_p = []

add_o = []

add_h = []

add_l = []

add_v = []

add_ch = []

for p in sprt_prices:

if len(p) == 2:

a = p[0]+p[1]

a = float(a)

add_p.append(a)

else:

a = p[0]

a = float(a)

add_p.append(a)

for o in sprt_open:

if len(o) == 2:

a = o[0]+o[1]

a = float(a)

add_o.append(a)

else:

a = o[0]

a = float(a)

add_o.append(a)

for h in sprt_high:

if len(h) == 2:

a = h[0]+h[1]

a = float(a)

add_h.append(a)

else:

a = h[0]

a = float(a)

add_h.append(a)

for l in sprt_low:

if len(l) == 2:

a = l[0]+l[1]

a = float(a)

add_l.append(a)

else:

a = l[0]

a = float(a)

add_l.append(a)

for v in vol_lst:

if v == '-':

add_v.append(0)

else:

exam = re.findall(r'K',v)

if len(exam)>0:

add = re.sub(r'K', '',v)

add = float(add)

add *= 1000

add_v.append(add)

else:

add = re.sub(r'M', '',v)

add = float(add)

add *= 1000000

add_v.append(add)

for i in change_lst:

add = re.sub(r'%', '',i)

add = float(add)

add_ch.append(add)

test_df = pd.DataFrame(data=(add_p, add_o, add_h, add_l,

add_v,add_ch)).T

test_df.columns = ['Price', 'Open', 'High', 'Low', 'Vol.', 'Change%']

return test_df

.

.

267 . .

, , , T-n, n — . . .

price = test_df.pop('Price')

price = price.drop(price.index[-1])

test_df = test_df.drop(test_df.index[0])

test_df.index = np.arange(len(test_df))

test_df = pd.concat((price,test_df), axis=1)

. , , , .

, - , , 45 .

PRACTICE_DS_SIZE = 45

later_testds_for_plot = test_df.iloc[:PRACTICE_DS_SIZE]

test_df = test_df.iloc[len(later_testds_for_plot):]

test_df = test_df.reset_index(drop=True)

, , . , , .

timestamps = test_df.pop('Date')

sum_outs = test_df.pop('out_sums')

— :

train = test_df.sample(frac=0.8, random_state=42)

test = test_df.drop(train.index)

train_labels = train.pop('Price')

test_labels = test.pop('Price')

.

def norm(train_data, data):

train_stats = train_data.describe()

train_stats = train_stats.transpose()

normalized_data = (data - train_stats['mean']) / train_stats['std']

return normalized_data

, .

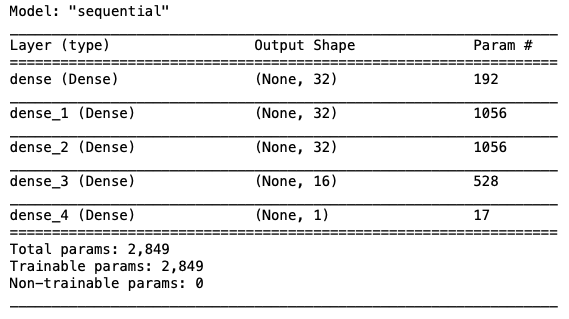

, , , :

def build_model():

model = keras.Sequential([

layers.Dense(32, activation='relu', input_shape=[len(train.keys())]),

layers.Dense(32, activation='relu'),

layers.Dense(32, activation='relu'),

layers.Dense(16, activation='relu'),

layers.Dense(1)

])

optimizer = tf.keras.optimizers.RMSprop(0.001)

model.compile(loss='mse',

optimizer=optimizer,

metrics=['mae', 'mse'])

return model

model = build_model()

model.summary()

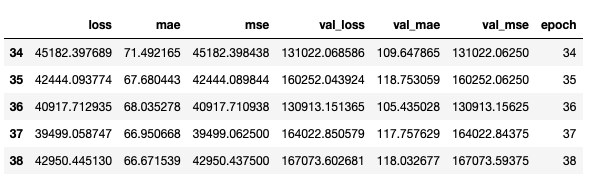

EPOCHS = 500

early_stop = keras.callbacks.EarlyStopping(monitor='val_loss', patience=10)

model.fit(normed_train_data2, train_labels2, epochs=EPOCHS,

validation_split = 0.2, verbose=0, callbacks=[early_stop, PrintDot()])

PrintDot() — . TensorFlow. . :

class PrintDot2(keras.callbacks.Callback):

def on_epoch_end(self, epoch, logs):

if epoch % 100 == 0: print('')

print('.', end='')

— , .

, .

.

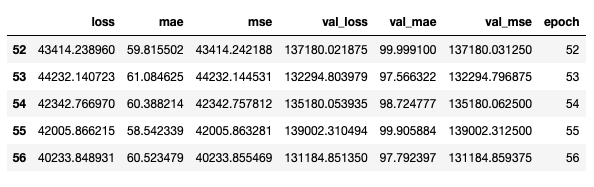

loss, mae, mse = model.evaluate(normed_test_data, test_labels, verbose=2)

: 506/506 — 0s — loss: 36201.9241 — mae: 66.5216 — mse: 36201.9219

MSE 45430.1133 190.27 . .

, .

loss, mae, mse = model.evaluate(normed_test_data2, test_labels2, verbose=2)

: 506/506 — 0s — loss: 24382.0926 — mae: 48.5508 — mse: 24382.0918

MSE 24382.0918 , 156.15 , , , , .

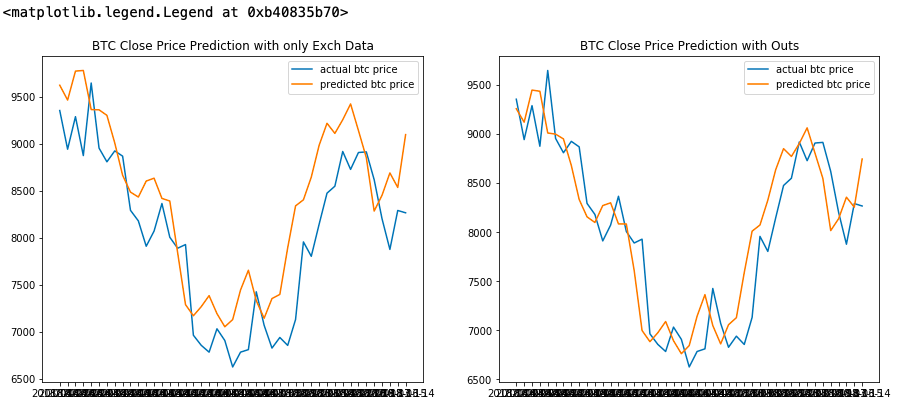

. .

actual_price = later_testds_for_plot.pop('Price')

actual_dates = later_testds_for_plot.pop('Date')

normed_practice_data = norm(train, later_testds_for_plot)

practice_prediction = model.predict(normed_practice_data).flatten()

actual_price2 = later_testds_for_plot2.pop('Price')

actual_dates2 = later_testds_for_plot2.pop('Date')

normed_practice_data2 = norm(train2, later_testds_for_plot2)

practice_prediction2 = model.predict(normed_practice_data2).flatten()

fig = plt.figure(figsize=(15,6))

ax1 = fig.add_subplot(121)

ax2 = fig.add_subplot(122)

ax1.plot(actual_dates,actual_price, label ='actual btc price')

ax1.plot(actual_dates,practice_prediction, label ='predicted btc price')

ax1.set_title('BTC Close Price Prediction with only Exch Data')

ax1.legend()

ax2.plot(actual_dates2,actual_price2, label ='actual btc price')

ax2.plot(actual_dates2,practice_prediction2, label ='predicted btc price')

ax2.set_title('BTC Close Price Prediction with Outs')

ax2.legend()

, , , . , , , , , .

, , . , , , .

, , « » ( - ), «».